Last week, before the legislature gaveled into our Fourth Special Session of 2021, I posted a recap of the third special session and what we knew at the time about what was coming up. Since that post, the start date was pushed from October 1st to October 4th and the agenda was changed from the broad item of “a fiscal plan” to four items, listed below.

Proclamation: https://gov.alaska.gov/wp-content/uploads/sites/2/Amended-4th-Special-Session-Proclamation-9-28-21.pdf

- An act making appropriations for a supplemental 2021 Permanent Fund Dividend for eligible Alaskans;

- An act or acts relating to the Permanent Fund Dividend Program

- SJR 6, HJR 7, or similar resolutions proposing amendments to the Constitution of the State of Alaska relating to the Alaska Permanent Fund;]

- SJR 5, HJR 6, or similar resolutions or acts proposing amendments to the Constitution of the State of Alaska relating to an appropriation limit;

- An act or acts relating to measures to increase state revenues;

And so, on October 4th we gaveled in and took up the first order of business, HCR 401 presented by Speaker Louise Stutes. This is a resolution which attempts to authorize longer than three day breaks between floor sessions. This is a good and a bad thing in that it saves money and will allow committee meetings to happen on the road system, but a risky thing in that we need to ensure progress is occurring. This HCR 401 passed the House and has been transmitted to the Senate, look at the following link for more information.

HCR 401: http://www.akleg.gov/basis/Bill/Detail/32?Root=HCR401#tab1_4

Alongside HCR 401, one constitutional amendment (My Spending Cap) and six other bills were introduced. Now, I am hopeful that hearings get scheduled and the bills that fit within the agenda for the fourth special session progress through the legislative process. I have included all of the bills in the House that I believe fit within each agenda item below.

Note: I’m not really including my position on every one of these, but providing a complete list of what can possibly be progressed this special session. Also, check out the FB Live Video I recorded 10/5/2021 with this information included.

An act making appropriations for a supplemental 2021 Permanent Fund Dividend for eligible Alaskans;

- HB 4001: SUPPLEMENTAL PFD

- Link: http://www.akleg.gov/basis/Bill/Detail/32?Root=HB4001

- Sponsor: Governor Mike Dunleavy

- Provides a supplemental dividend of roughly $1250/eligible Alaskan.

An act or acts relating to the Permanent Fund Dividend Program

- HB 42: PFD / Allowable Absences

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=HB42

- Sponsor: Representative Andi Story

- Provides for allowable absences of those serving in the National Oceanic and Atmospheric Administration Commissioned Officer Corps or the United States Public Health Service Commissioned Corps

- HB 73: Perm Fund; Advisory Vote

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=HB73

- Sponsor: Governor Mike Dunleavy

- The bill providing the statutory changes associated with the Governor’s constitutional amendment relating to the Permanent Fund, HJR 7. This has a companion bill in the Senate, SB 53, which has held more hearings than this house version.

- HB 97: Land Vouchers; PFDs

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=HB97#tab1_4

- Sponsor: Governor Mike Dunleavy

- An extremely intriguing bill that creates an option for Alaskans to choose to receive a voucher towards the purchase of State land in lieu of a cash permanent fund dividend.

- HB 142: PFD Eligibility

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=HB142#tab1_4

- Sponsor: Representative Ken McCarty

- Removes military members stationed outside of Alaska from PFD eligibility. Deployed military members would remain eligible for the dividend.

- HB 158: PFD Contributions to the General Fund

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=HB158

- Sponsor: Representative Mike Prax (Cosponsored by 23 other representatives)

- Sets up a mechanism to give Alaskans the choice of donating all or a portion of their Permanent Fund dividends (PFDs) directly to the state’s general fund. Participants would be able to donate ranging from a minimum of $25 to the full amount of their PFD in increments of $25.

- HB 202: Permanent Fund Dividend; Royalties

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=HB202

- Sponsor: Representative Kelly Merrick

- Designates 30% of all mineral lease rentals, royalties, royalty sale proceeds, federal mineral revenue sharing payments, and bonuses received by the state during that fiscal year for distribution of dividends. More succinctly the dividend would equal 30% of royalties from the previous year. Ends up with a roughly $500 dividend at current production levels, but those values can be fairly volatile

- HB 4003: Permanent Fund Dividend; 75/25 split

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=HB4003

- Sponsor: House Ways & Means Committee

- This is a statutory change to the PFD formula which would take an annual draw of 5% of the average market value of the Permanent Fund for the first five of the last six years (5% POMV Draw). This 5% would then be split with 75% going towards government operations and 25% going towards the PFD. This is roughly a $1250 dividend at current values and increasing with fund value

SJR 6, HJR 7, or similar resolutions proposing amendments to the Constitution of the State of Alaska relating to the Alaska Permanent Fund;

- HJR 1: Permanent Fund, POMV

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hjr1

- Sponsor: Representative Jonathan Kreiss-Tomkins

- Constitutionally limits annual appropriations out of the Permanent Fund to 5% of the average of its market value for the first five of the preceding six fiscal years

- Merges the Earnings Reserve Account with the Principal.

- HJR 7: Permanent Fund and PFDs

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hjr7

- Sponsor: Governor Mike Dunleavy

- Constitutionally limits annual appropriations out of the Permanent Fund to 5% of the average of its market value for the first five of the preceding six fiscal years

- Merges the Earnings Reserve Account with the Principal.

- HJR 10: Permanent Fund, POMV, Dividend

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hjr10

- Sponsor: Chris Tuck

- Constitutionalizes an income-based PFD Formula

SJR 5, HJR 6, or similar resolutions or acts proposing amendments to the Constitution of the State of Alaska relating to an appropriation limit;

- HJR 6: Appropriation Limit, CBR

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hjr6#tab1_4

- Sponsor: Governor Mike Dunleavy

- Changes the constitutional spending limit. Appropriations may not exceed prior three-year average spending by more than the greater of inflation or population growth

- Amends Constitutional Budget Reserve (CBR), State savings, access provisions to allow spending from the CBR by a simple majority vote. Rather than the current ¾ vote margin needed

- HJR 401/HB4006: Appropriation Limit, GDP

- Resolution Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hjr401

- Bill Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hb4006

- Sponsor: ME! Representative James Kaufman

- A new, functional cap which uses a factor based upon a five-year trailing average of our private sector economic performance. Specifically, Real GDP less government spending, which measures the value produced within our borders. This kind of a cap creates a constructive link to our private sector, smooths volatility, and leads to stability.

- HB 141: Appropriation Limit; Gov Budget

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hb141

- Sponsor: Representative Ivy Spohnholz

- Changes the spending limit statutes only, not the constitution. Similar to HJR6 because appropriations may not exceed prior three-year average spending by more than the greater of inflation or population growth

- Different from HJR 6 because this bill, HB 141, adds school bond debt reimbursement to the list of appropriations not subject to the limit

An act or acts relating to measures to increase state revenues;

- HB 9: Income Tax + PFD

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hb9

- Sponsor: Representative Sara Hannan

- An Income tax bill. A broad-based tax on individuals who live and work in the state, trusts, estates, partners in certain organizations, and more.

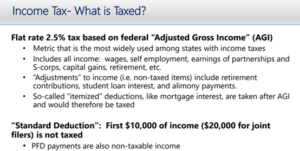

- HB 37: Income Tax + PFD

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hb37

- Sponsor: Representative Adam Wool

- An Income tax bill with perhaps a little more momentum. A flat rate 2.5% income tax based on federal AGI. A standard deduction. Would raise an estimated $600 million per year.

- HB 81: Oil/Gas Lease; DNR Modify Net Profit Share

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hb81

- Sponsor: Governor Mike Dunleavy

- Passed House unanimously, now in Senate Finance

- Would authorize the Commissioner of Department of Natural Resources (DNR) to modify North Slope leases. This encourages production and has the ability to prolong production and life of fields and pools.

- Unknown revenue benefits

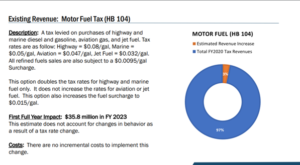

- HB 104: Motor Fuels Tax; Vehicle Registration Fee

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hb104

- Sponsor: Representative Andy Josephson

- Roughly similar to the slide below from a DOR presentation.

- HB 130: Corp. Tax; Remove Exemptions / Credits

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hb130

- Sponsor: Representative Adam Wool

- Expands CIT to all Oil and Gas producers (including S-Corporations), Reduces a refund liability of the state, Restricts the ability of corporations to claim federal tax credits for work that has nothing to do with Alaska, and Removes the ability to deduct foreign royalties from a company’s income calculation

- Would raise roughly $200 million in new revenue

- HB 189: Employment Tax for Education

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=Hb189

- Sponsor: House Ways & Means Committee

- Income tax ranging from $50 – 500 depending on individual income and for the purpose of education. Would raise roughly $65 million / year

- HB 214: Income Tax

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=HB214#tab1_4

- Sponsor: House Ways & Means Committee

- A broad-based income tax on individuals living and working in Alaska

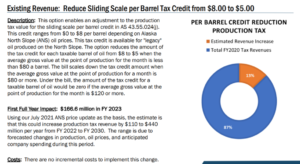

- HB 4002: Oil and Gas per barrel tax credit

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=HB4002

- Sponsor: Representative Geran Tarr

- Similar to the Slide pictured, however this bill reduces the credit to $4. Therefore the estimated first year revenue is slightly higher.

- HB 4004: Oil and Gas Production Tax

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=HB4004

- Sponsor: Representative Geran Tarr

- Increases Alaska’s minimum tax on oil and gas production from four percent to six percent, as well as suspending all other components of the oil and gas tax until December 31, 2024.

- HB 4005: State Sales and Use Tax (Tarr)

- Link: https://www.akleg.gov/basis/Bill/Detail/32?Root=HB4005

- Sponsor: Representative Geran Tarr

- A 2% Sales tax, which exempts items such as groceries, heating oil, health care services, and some others